Blockchain Enables New Power Market

Blockchain Enables New Power Market

An encrypted electronic ledger may help microproducers and individual consumers buy and sell small quantities of renewable energy.

From his research post at the Electric Power Research Institute in Knoxville, Tenn., Gerald Gray keeps his eye on the underpinnings of how electricity is produced and distributed by utilities across the grid. What he sees is change—rapid change. Traditional generating stations that produce baseload power measured in hundreds of megawatts are either closing or struggling, unable to compete with inexpensive power produced by solar, wind, or natural gas-burning plants.

To handle these multitude of distributed, small-bore sources, a new smart grid is developing, where small buyers and sellers of electricity may find a marketplace. But for that to break into the mainstream, a new system linking disparate generators, buyers, and sellers with fast and secure transactions still needs development.

Many industry experts suggest that this new system could well be based on blockchain, a digital technology commonly associated with cryptocurrencies such as Bitcoin. There are several pilot projects moving in various market segments, but only a few are on the verge of true commercial operation.

“There’s lots of projects out there that are pilots,” said Gray, who has been tracking blockchain since 2015. “They are interesting but they’re not quite the real thing. What is real is a project scaled to millions of transactions and thousands of users.”

However, the specific market demands of the energy sector have highlighted weaknesses in speed, security, and transparency in cryptocurrency transactions. Developers now are scurrying to produce solutions.

The potential is huge. According to Ernst & Young, more than $1 billion of venture capital has been tapped by a burgeoning group of startups looking to build the market. Still, the consulting firm believes a system to support a globally connected network of energy transfer, using smart devices to react to market signals and securely send and receive data, is at least five years off and probably more.

Recommended for You: Energy Special Report

“It is kind of in the ‘me too’ phase,” Gray said. “I think we’re all in the process of learning.”

Explanations of blockchain can make it sound impenetrable, but at its heart, it is a decentralized ledger to record and verify transactions. But rather than rely on a central entity to maintain or validate activity, blockchain runs on a large distributed network of computers and is visible to all users. In theory, it enables fast, secure, and transparent trading and transactions.

In practice, the distributed nature of the system slows it down. The Bitcoin blockchain, for instance, now can process 4.6 transactions per second, well below a level needed for large-scale future energy transactions.

One effort to bring the technology up to speed is being led by the Energy Web Foundation (EWF), a nonprofit founded in 2017 that now has over 100 affiliates ranging from major corporations like Shell to utilities to startups developing various apps to run off of a blockchain system. EWF’s test network, codenamed Tobalaba, is scheduled to go live this month, and will begin actually processing transactions and flowing currency across the platform, said Jesse Morris, EWF chief commercial officer.

EWF’s approach was to develop a platform in conjunction with its affiliates, who represent a diverse group of players in the energy sector. Rather than use an off-the-shelf blockchain platform, Tobalaba has been customized based on input from EWF’s stakeholders. “The energy market requires a blockchain tailored to the sector itself,” said Peter Bronski, EWF director of marketing.

Unlike Bitcoin, which requires new “coins” to be mined through the energy-intensive process of solving a computationally complex problem, the Tobalaba system instead uses blockchain to record the provenance and track the ownership of renewable energy production, including details of source type, location, time, and emissions. Existing systems to track those attributes—which are critical to authenticating purchase and delivery of renewable energy—are complicated and are centrally managed through a third party. Confirmation of certification can take weeks. The hope is that blockchain-based systems will speed the process and provide transparent and accurate tracking and trading.

There have been some successful projects involving certificates of origin. Spanish utility Iberdrola used a platform developed by Madrid-based FlexiDAO on the EWF platform.

“We’re essentially a bridge between the utility and the actual blockchain,” said Joan Collell, FlexiDAO’s business and strategy leader. “All utilities are exploring blockchain technology now, but most are still at the exploratory level. But they are starting to request positive business cases and real value. So we are starting with a simple use case.”

Iberdrola used FlexiDAO’s Spring software to provide real-time guarantees of origin of renewable energy delivered to Kutxabank, a bank based in northern Spain. The energy was sourced from one hydropower plant and two wind farms. The utility reported the technology allowed automatic execution of smart contracts and eliminated intermediaries. Kutxabank officials also monitored the energy supply through a web-based interface platform.

Tracking Small Transactions

Proving certificates of origin is only one energy application for blockchain. More popular might be supporting a peer-to-peer network for customers to buy, sell, or trade power with one another, opening the market to ever smaller participants. Single family homes with solar panels, for instance, could sell excess power to another consumer, or buy it back if needed because a blockchain platform could support the slug of very small transactions that existing centralized systems cannot.

“We’re going after the kilowatt hour,” said EWF’s Morris.

Pilot projects are taking place around the world. In Norway, the giant utility Vattenfall is experimenting with a private blockchain network to record energy transactions in which commercial or residential customers can sell power coming from their solar panels or batteries. And in the United States, the Brooklyn Microgrid project in New York City is entering its third year of operation and is recognized as the first successful peer-to-peer blockchain system.

Built and operated by LO3 Energy Systems, the Brooklyn Microgrid connects about 60 rooftop solar sites in three neighborhoods, with about 500 people buying and selling over the system through a mobile app. It relies on custom-designed smart meters that communicate via LO3’s Exergy platform, enabling locally generated renewable energy to be bought, sold, and delivered to a customer, said Lawrence Orsini, LO3’s CEO.

The goal of the Brooklyn Microgrid was to give people a choice over what type of energy they use, and prove a new model of distributed renewable resources. Orsini said early focus groups interested in buying green energy were surprised there were no guarantees the electricity they bought from some suppliers actually came from a renewable source.

“The idea that you can get electrons from upstate to you is not very accurate,” he said.

The platform enables the real-time transaction of energy within the microgrid. Using the mobile app, customers can set a predetermined bid price for purchasing local energy, and so-called prosumers—individuals or businesses that choose to sell or trade power produced on their own solar panels or batteries—can sell their excess energy to the local market or continue to sell to the utility-owned grid. The blockchain-based system is used for communication, processing transactions securely.

“One of the bigger issues we’ve been grappling with in distributed networks is communications,” Orsini said. “Getting nodes to communicate effectively can be tricky.”

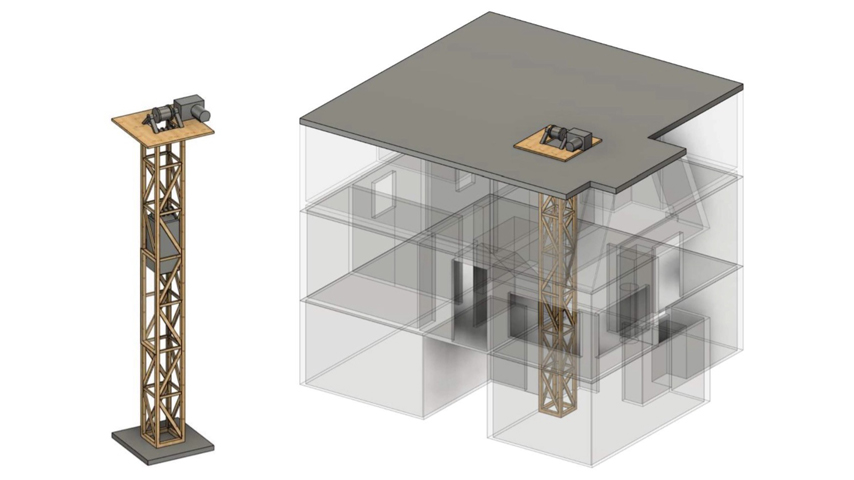

Utilities are also planning for blockchain. Recently, St. Louis-based utility Ameren announced a partnership with software engineering firm Opus One Solutions to build a transactive market using the microgrid at the utility’s Technology Applications Center near the University of Illinois in Urbana-Champaign.

Ameren’s microgrid includes a 1-MW natural gas generator, a 1-kW wind turbine, 125 kW of solar generation, and 250 kW of battery storage. The company claims this will be the first microgrid capable of seamlessly moving distributed generation sources to the traditional grid, instead of operating as an island.

The idea is to enable these distributed energy resources to communicate and make decisions on optimizing the energy mix and deciding if and when to move electricity to the grid.

The first phase of the project will be simulated using models developed by Ameren followed by testing using the microgrid’s systems and controls. The goal is to create a simulated market with day-ahead, hour-ahead and 15-minute-ahead prices for energy at the locational marginal pricing hub from the transmission system of MISO, the grid operator.

Enabling New Technologies

Blockchain also may prove itself in enabling the acceptance of electric vehicles. “It is an interesting starting point,” said EWF’s Jesse Morris. He and others see the technology enabling fast transactions at charging stations because of its ability to handle large volumes of small transactions.

That’s already happening in Europe and California.

Another startup, eMotorWerks, is partnering with Germany’s MotionWerk in California to create a peer-to-peer market for EV charging based on shared facilities. A mobile app, called Share&Charge, will connect EV drivers with residential and commercial EV charging stations and handle blockchain-based payments between drivers and station owners. The goal is to increase the availability of charging stations and decrease range anxiety.

MotionWerk is a startup that emerged from innogy SE, a subsidiary of the giant utility RWE. Innogy was spun off in 2016 when RWE split its renewable and network operations into a separate utility.

Other large players are also testing blockchain. The PJM Interconnection, which operates a grid encompassing much of the east-central United States, is testing a system in partnership with EWF to track, trade and verify renewable energy certificates, known as RECs. It already does so at the wholesale level, at the scale of megawatt hours.

Jaclyn Lukach is vice president of PJM Environmental Information Services, the PJM subsidiary working on the project. She said certifying RECs is slow and time consuming.

“It could take a number of months after a REC is retired for external auditors to provide documentation,” she said. “So we are looking to see how that would be reduced. We’re still trying to envision what this will look like.”

Lukach said blockchain has the potential to bring much smaller packages of energy into play from small prosumers “at the kilowatt hour level.” The PJM platform will also be built from EWF’s software toolkit and will be open source so it can be modified by any potential participant.

The systems will first run in a simulated environment with no transactions or exchange of currency.

Lukach said regulators are not involved because PJM is targeting the voluntary market—customers purchasing renewables to meet individual goals or marketing claims. The compliance market is different and regulators are beginning to note blockchain’s arrival.

Illinois regulators already are pushing investor-owned utilities to include distributive sources into their generating mix and the grid.

Other states, including New York, Minnesota, California, and Nevada, are introducing similar plans. In New Jersey, which sits on the edge of the PJM system, officials are working on a new energy master plan that relies on diversified sources to wean the state off of fossil fuel by 2050.

“There’s a lot of new technology developing and it is a little premature to judge things,” noted Cynthia Holland, director of the Office of Federal and Regional Policy for the New Jersey Board of Public Utilities. “But it is happening in real time and there is a significant amount of regulatory uncertainty.”

Decentralized Authority

EPRI notes a number of regulatory changes needing action for blockchain and distributive energy to move ahead. For instance, most current regulatory frameworks do not allow consumer-to-consumer trading of the sort conducted within the Brooklyn Microgrid project. New contract types will be needed to handle that type of electricity trading, particularly when the electricity is first sent to the regional electric grid. And a new framework would require new and more flexible electricity tariffs that now are heavily regulated.

Smart contracts will also have to be finalized and put into the legal code—not only to comply with the law but to protect consumers. Since trust in blockchain-based systems is placed in technology itself rather than a central authority, ultimate legal and technical liability for negative consequences remains poorly defined. For instance, if a successful hack into a decentralized energy trading system disrupts the flow of power, where do customers lodge a complaint?

EWF’s Bronski believes the issue will eventually resolve itself. “At both the state and federal level we’re seeing a healthy interest in regulators educating themselves,” he said.

LO3’s Orsini added: “I spend 30 percent of my time talking to regulators, and they have been open to the technology. Regulations in place today are going to change pretty quickly. What is necessary are proof points so regulators can see nothing is broken and there are real, viable results.”

You May Also Like:

Energy Special Report 2019

The Chain Gang

Renewable Energy Experts Shine Light on Solar Farms and Grids